Nordic economies are performing well in the European context, with the strongest growth observed in the largest urban areas. There are a number of regions that are also performing well however it is important to note that the topperforming economies in the more peripheral regions are often thriving due to a large single industry. Private sector R&D investment has seen similar concentration in large Nordic cities, in particular the capitals Stockholm, Oslo and Helsinki Employment in knowledge-intensive sectors in Nordic Regions has been more evenly distributed with the exception of the northern parts of Finland, Sweden, and Norway, which lag far behind their southern counterparts. Tourism emerged as a potential new driver of Nordic economies thanks to extensive growth in travel to Sweden and especially to Iceland by a wide range of international tourists in the period 2008- 2014. The potential to expand this phenomenon to the whole Nordic Region remains, for the most part, unrealised but increased collaboration on tourism branding between countries would be a good first step. There is also scope for more broadly focused regional development policy to ensure resources and opportunities are distributed evenly between regional areas and their metropolitan counterparts. Ecoinnovation is currently “scattered” across the Nordic countries but represents great potential to provide new opportunities both to big city regions and to sparsely populated regions.

Chapter 8

ECONOMIC DEVELOPMENT: Economically strong but crisis still shows

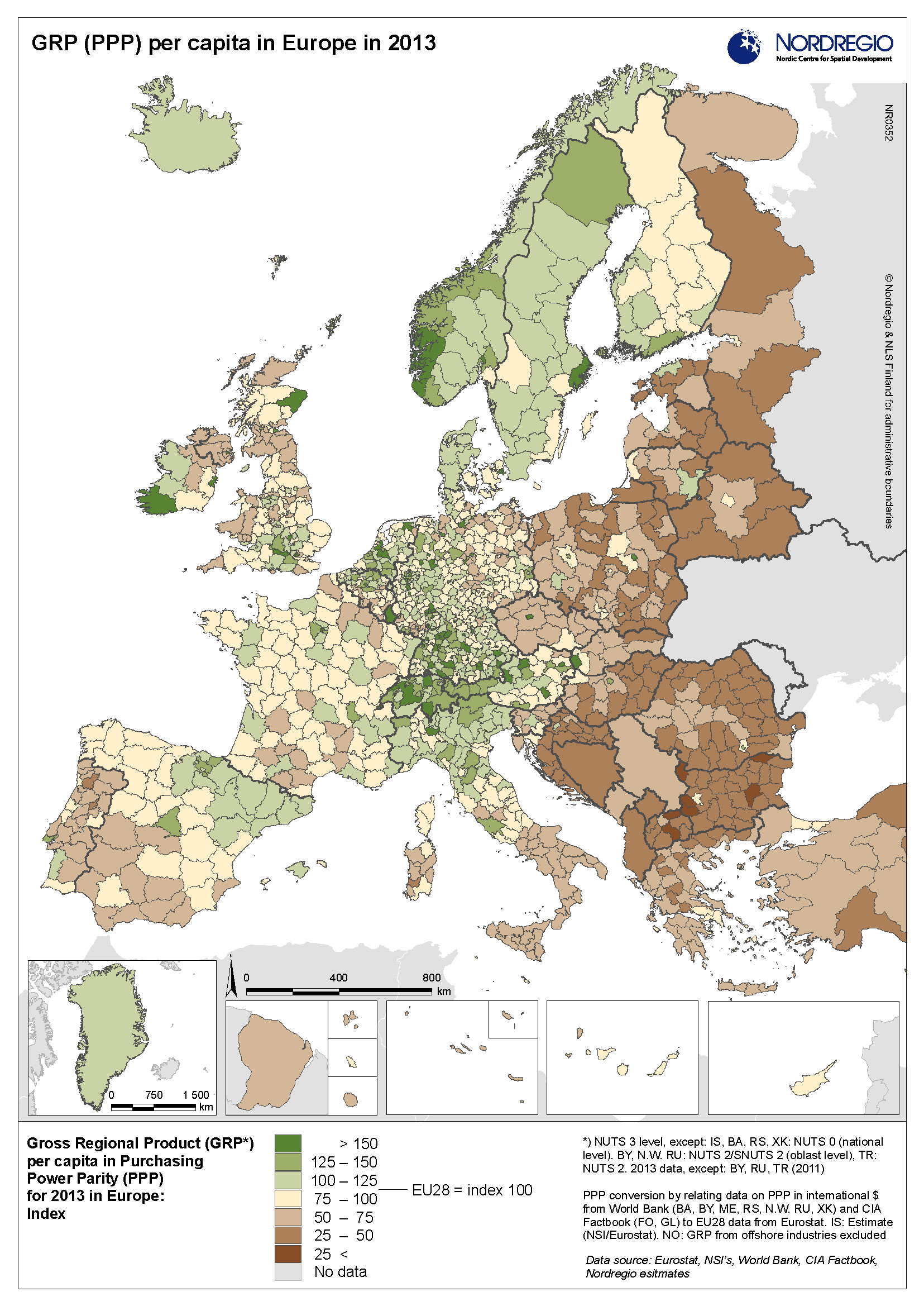

The Nordic Regions have generally maintained their previously strong positions in relation to the EU average when it comes to economic development. Urban and capital city regions show high levels of GRP per capita, as is the pattern throughout Europe. Stockholm, Oslo, Copenhagen and the western Norwegian regions are among the wealthiest in Europe. It is also the case that capital regions and larger cities remain strong economic centres in the Nordic Region. These regions show GRP per capita levels which correspond, or even exceed, most other metropolitan regions in Europe. While southern European city regions have suffered reductions in relative GRP (Gross Regional Product) per capita, Nordic city regions continue to place at the top of the scale. The picture is not however as clear cut as it once was. Helsinki has for instance lost its position among the highest performers in the last 3-years. And in Denmark and Sweden some regions now have a significantly lower GRP per capita compared to previous years; notably Kalmar, Värmland, Hovedstaden, Syddanmark and Östfold; the same is also true for Åland. At the same time other regions are improving and have risen up the rankings e.g. Hordaland in Norway.

In addition to the urban regions referenced above, there are now also a number of peripheral regions displaying high levels of GRP per capita (figure 8.1). The Swedish and Norwegian northern regions are all performing well in relation to the European average. Indeed, some of these regions can even be viewed as ‘top performers’. Greenland and the Faroe Islands are also above the European average (for Greenland though, Danish subsidies supply roughly 60% of government revenue and 40% of Greenland’s GRP). However promising these facts may appear, they should nevertheless be seen in the context of the existing economic structures in those territories. Indeed, whereas urban economies are often based on a diverse range of economic activities and benefit from trends in urban growth, the economies in the top-performing but more peripheral regions are usually thriving thanks to a large, single industry often highly specialised internationally: in Åland, the transport sector; in Norrbotten, mining; and in Northern Norway, oil exploitation and fisheries.

Defining GRP

The indicator Gross Domestic Product measures the overall economic output of all economic activities in a country (measured in terms of´purchasing power parity, or standards). The corresponding indicator at the regional level is the Gross Regional Product (GRP). Although these measures are somewhat blunt (for instance they do not consider sustainability) in the assessment of regional performances they are still the most stable and most commonly harmonised measure for economic comparisons. Together with the labour market and other business- related indicators in this report they provide an understanding of regional economic development.

Read the chapter 8

Chapter 9

INNOVATION: Nordic lead the charts

Existing global challenges and continuing economic pressures place innovation at the forefront of Europe’s efforts to transform the economy and stimulate global competitive advantage. The Europe 2020 Flagship Initiative, Innovation Union aims ‘to improve conditions and access to finance for research and innovation, to ensure that innovative ideas can be turned into products and services that create growth and jobs’ (COM 2010). In the Nordic Region, innovation is also high on the agenda. Sweden, Denmark, and Finland are the top performers according to the European Commission’s Innovation Union Scoreboard 2015 and therefore offer interesting examples of how to create conditions that facilitate innovation and contribute to the EU’s smart growth strategy.

Read the chapter 9

Chapter 10

TOURISM: A new economic driver?

Tourism has become big business and a key services export for many economies around the world. Tourism contributes to job creation and regional economic development (OECD, 2014). The importance of the tourism industry for the Nordic economies has, moreover, mandated the development of national and regional tourism strategies across the region. Most of these strategies incorporate the principle of sustainable tourism development (see box). The role of tourism in regional development strategies is particularly evident in rural and peripheral areas, where, as a result of the socioeconomic changes taking place, tourism is in many places viewed as a replacement industry for traditional rural livelihoods (Hall et al., 2009), or as a complement to traditional, often male-dominated industries. However, as it is also evident in this chapter, tourism plays a role in both the rural and urban areas of the Nordic Region. The reasons why tourists travel to the Nordic Region are many and include for example – nature-based experiences, coastal tourism, culture experiences, urban tourism, and business meetings and conferences. These types of tourism experiences do however vary significantly between regions. Current trends in tourism, globally, point towards shorter trips, either domestic in nature or closer to home, and to a search for more ‘authentic’ experiences. Holidays remain by far the main reason for taking an international trip (71%) ahead of business travel and visiting friends and relatives. More people fly than use their cars or other means of transport (OECD, 2014:23). As will become evident in this chapter, the highest shares of visitor numbers in most Nordic Regions are comprised by domestic tourists and visitors from neighbouring countries. One of the most popular ways of measuring tourism is to count the number of overnight stays. This approach will be utilised in this chapter. In the Nordic context, Iceland has experienced significant growth in tourism numbers to destinations across the country during the period 2008-2014 while Swedish regions have also seen a remarkable growth in overnight stays during the same period. In 2014 the total numbers of overnight stays were highest in the region of Syddanmark, closely followed by those in the capital regions of Sweden and Denmark.

Read the chapter 10